December 1, 2025

Overview of Altoona’s Budget:

A look into mill rates, economic development, and construction projects.

A budget committee composed of the Mayor and City Council members prepared a comprehensive budget document detailing proposed revenue and expenditures for the City of Altoona (2026). The budget included renovations to expand and remodel the public library, fund the construction of a new Fire Rescue and EMS building, lower mill rates, and close TIDs. On November 20, 2025, the City Council held a public hearing and voted that evening, where the budget was successfully passed.

The money Altoona receives (from taxes, permits, fines, and public services, etc.) is called revenue. For example, in the 2026 budget, fines & forfeitures are projected to bring 65.3 thousand dollars into the City, an 8.48 percent increase from the previous year. In total, the budget includes a significant decrease in total revenue, coming in at 8.47 million dollars (a 43.5 percent decrease from the previous year).

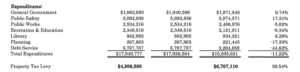

Expenditures are what the County spends its revenue on. For example, the 2026 proposed budget includes appropriations for public safety, public works, and the library (to name a few). Total expenditures are also 11.22 percent down, coming from 17.9 to 15.9 million dollars.

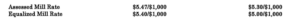

Mill rates or levies are a type of property tax that is set each year by local governments, such as Altoona's City Council. These tax rates are used to calculate property tax, with one mill being equal to one dollar of tax for every 1,000 dollars of a property's assessed value. For example, if a home has an assessed value of 200,000 dollars, we would divide that value by 1,000 (to get 200) and multiply that number by the mill rate to get the annual property tax bill. Altoona's proposed budget would lower the mill rate to 5.30 for every 1,000 dollars (meaning, in our example, the property tax would be 1060 dollars annually). This rate is down from 5.47 dollars in 2025.

Altoona has multiple Tax Incremental Districts (TIDs) that are closing or scheduled to close soon, which will make funds available for other purposes, such as housing funds, debt repayment, or other projects. For example, in 2025, TID produced more revenue than needed, so Altoona transferred money and used it to pay $4.5 million in debt. TIDs in general are used to make an area more attractive for businesses and residents by funding infrastructure, public improvements, and other development-related costs.

Budget meetings also held discussions on a 5.4 million dollar library expansion, applying for a state grant (which will match up to 2 million), and plans for the project to begin in 2030. This expansion would include a new addition, a space remodel, and other site projects.

Shifting expenses and revenue sources reflect changing priorities as documented by the proposed 2026 budget; however, why is it important for business owners and citizens to be aware of these changes? Changes in proposed operational budgets affect the availability of public services, the public's ability to hold officials accountable, quality of life, and changes in taxes and fees. When a government shifts its revenue structure (for example, by decreasing the mill rate), it may need to raise local taxes to make up for the shortfall. Individuals who understand where revenue is coming from can anticipate potential tax increases and look to see if they match with the services being provided.

Written by Brennen Bolopue, Eau Claire Chamber of Commerce

Governmental Affairs Intern

Bolopue@eauclairechamber.org

More information on Altoona’s budget

Hearing notice and budget book (Altoona)

Proposed Altoona Budget lowers mill rate, plans for new Fire & Rescue building (WQOW)