January 15, 2026

Mill Rates Explanation

Property taxes are the responsibility of anyone owning property, such as land, buildings, and commercial areas, but how are these taxes calculated? Mill rates are a type of levy set by local governments every year to calculate property taxes. A single mill is equal to one dollar of tax for every 1,000 dollars of a property’s assessed value. An assessed value is used to distribute an area’s tax burden among individual property owners and is reassessed every three years. For example, if a home has an assessed value of 200,000 dollars, we would divide that value by 1,000 (to get 200) and multiply that number by the mill rate to get the annual property tax bill (see further examples below). When the Eau Claire City Council finalized its city operating budget, it also included updating its mill rate numbers.

Credit: How Much are My Property Taxes? - City of Eau Claire

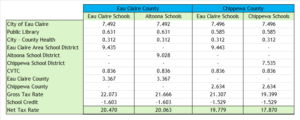

Comparison of Local Mill Rates

As previously explained, to calculate your property taxes, divide your assessed value by $1,000 and then multiply by the tax rate for where you live. If you, for example, lived in Eau Claire County and a Eau Claire School District, your calculation would look something like this:

(2026) Eau Claire County and Eau Claire District = $200,000/$1,000 = $200 x 20.470 = $4,094.00

And if lived in Eau Claire County, but lived in a Altoona School District, your calculation would look like this instead:

(2026) Eau Claire County and Altoona District = $200,000/$1,000 = $200 x 20.063 = $4,012.06

Comparison to 2023 Local Mill Rates

In 2023, the Eau Claire Chamber of Commerce posted a page on mill rates and explained similarly to how this page has above, but how do the numbers compare? Following the finalization of the 2023 city operating budget, the total* mill rate for an individual living in Eau Claire County and a Eau Claire School District was 18.98.

(2023) Eau Claire County and Eau Claire District = $200,000/$1,000 = $200 x 18.98 = $3,796

The total* mill rate for an individual living in Eau Claire County and Altoona School District was 17.94.

(2023) Eau Claire County and Altoona School District = $200,000/$1,000 = $200 x 17.94 = $3,588

For more information (and to see the post on 2023 mill rates), you can click this link!

Why Should We Care?

Mill rates directly determine how much in property taxes an individual will pay. It is incredibly important to pay your property taxes as they go to fund essential local services like schools and roads. Understanding mill rates allows you to participate in local budget discussions and be fiscally prepared for years to come.

Written by Brennen Bolopue, Eau Claire Chamber of Commerce

Governmental Affairs Intern

Bolopue@eauclairechamber.org

More information on Mill Rates

How Much are My Property Taxes? - City of Eau Claire

Tax Overview (FY 2026 Annual) - City of Eau Claire

Mill Rates Explanation - Eau Claire Chamber of Commerce